The Visual Pipeline Approach

Sales representatives juggle dozens of opportunities simultaneously—prospects in various conversation stages, pending proposals, negotiations approaching close dates, and stalled deals requiring attention. Spreadsheets become unwieldy. Email threads scatter across inboxes. Critical follow-ups slip through cracks.

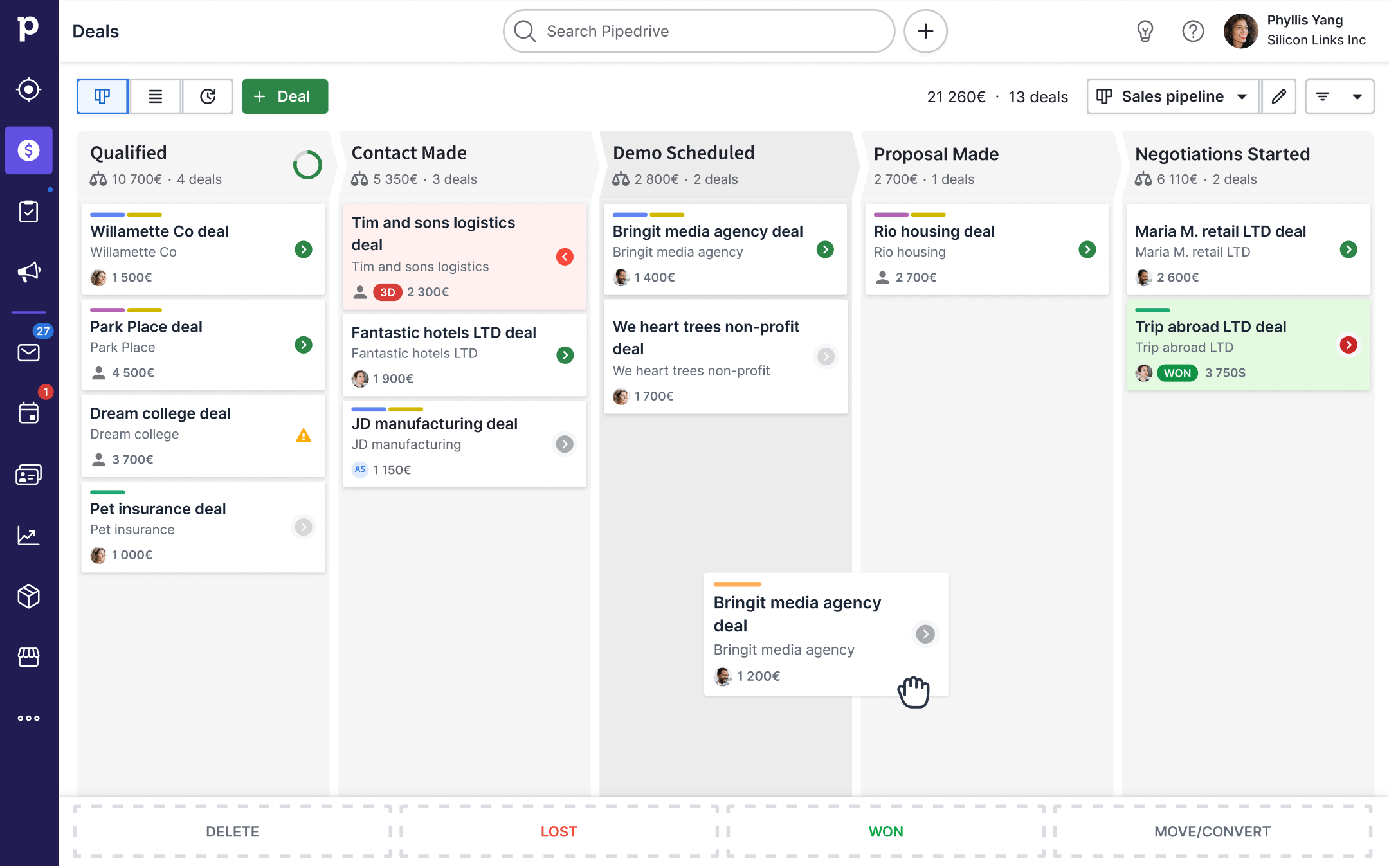

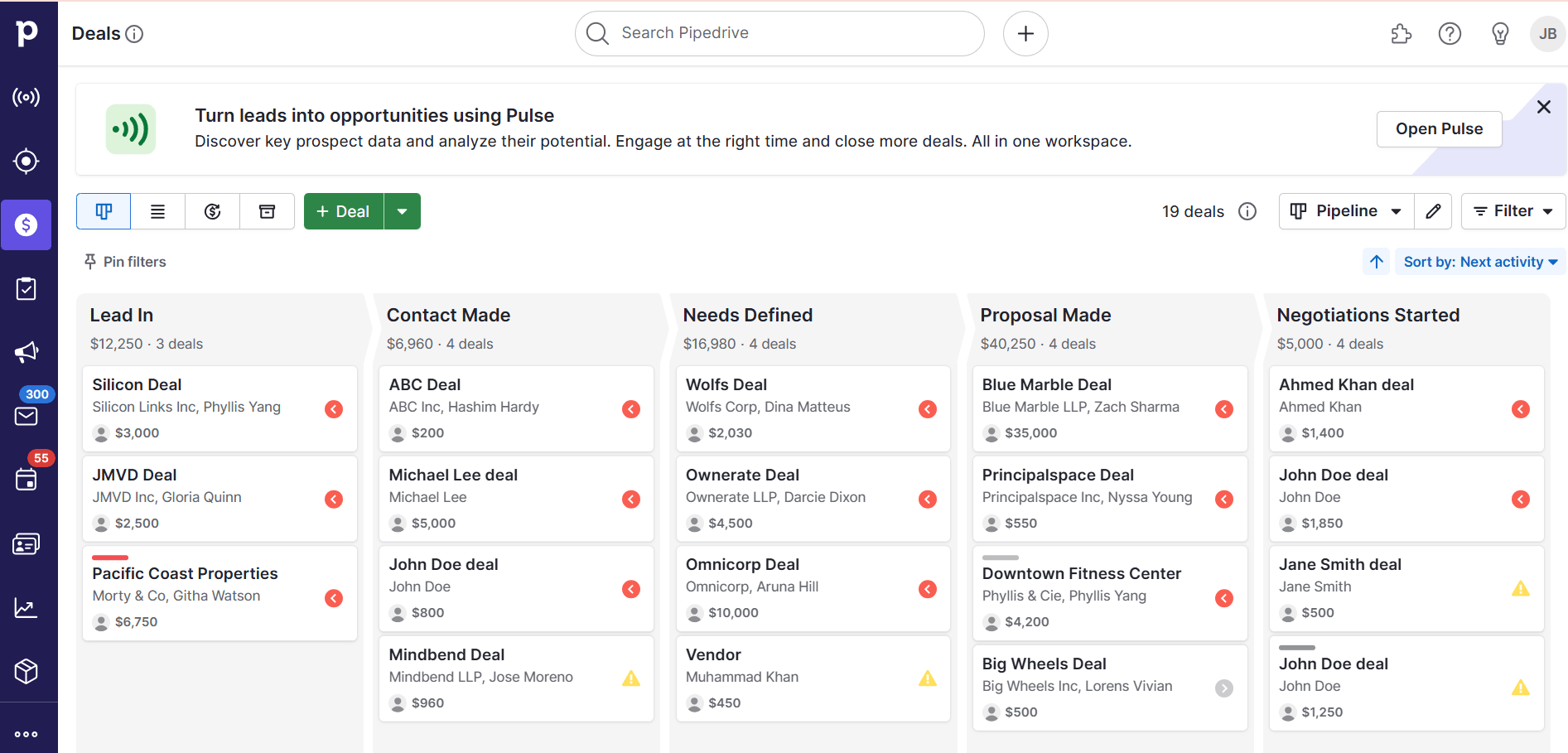

Pipedrive addresses this chaos through radical visual simplicity. Instead of endless data tables or cluttered dashboards, the platform centers everything around intuitive pipeline boards. Deals display as cards arranged across customizable stages. Progress happens through drag-and-drop gestures. Bottlenecks become immediately obvious.

This review examines Pipedrive based on extensive hands-on testing—importing real contact data, building multiple pipelines, configuring automations, testing integrations, and executing complete sales workflows. We'll explore what works exceptionally well, where limitations surface, and which teams benefit most from Pipedrive's focused approach.

Pipedrive Overview and Philosophy

What Pipedrive Actually Is

Pipedrive is a sales-focused CRM platform emphasizing visual pipeline management and activity-based selling. Launched in 2010 by sales professionals frustrated with existing CRM complexity, the platform prioritizes deal progression over comprehensive feature breadth.

The core philosophy: sales tools should help representatives sell, not drown them in administrative tasks. Pipedrive eliminates features that don't directly support deal advancement, creating unusually clean interfaces and straightforward workflows.

Over 100,000 companies currently use Pipedrive, primarily small to mid-size B2B organizations with defined sales processes and moderate cycle lengths.

Core Strengths and Limitations

Primary advantages:

- Visual clarity: Pipeline boards make deal status and movement immediately obvious without reports or queries

- Rapid deployment: Most teams achieve productivity within hours, not weeks, of initial setup

- Activity emphasis: The system constantly surfaces next actions, reducing follow-up failures

- Integration quality: Connections to email, calendars, and communication tools work reliably

- Focused scope: Deliberate feature restraint prevents overwhelming complexity

Notable constraints:

- No free tier: Only 14-day trials available, requiring subscription commitment for continued use

- Sales-only focus: No native support for marketing automation, customer service, or post-sale workflows

- Basic reporting: Standard analytics prove sufficient for most teams but lack depth enterprise organizations require

- Linear automation: Workflow builders don't support sophisticated branching logic or conditional paths

- Add-on costs: Many valuable features (campaigns, chatbots, web visitor tracking) require separate purchases

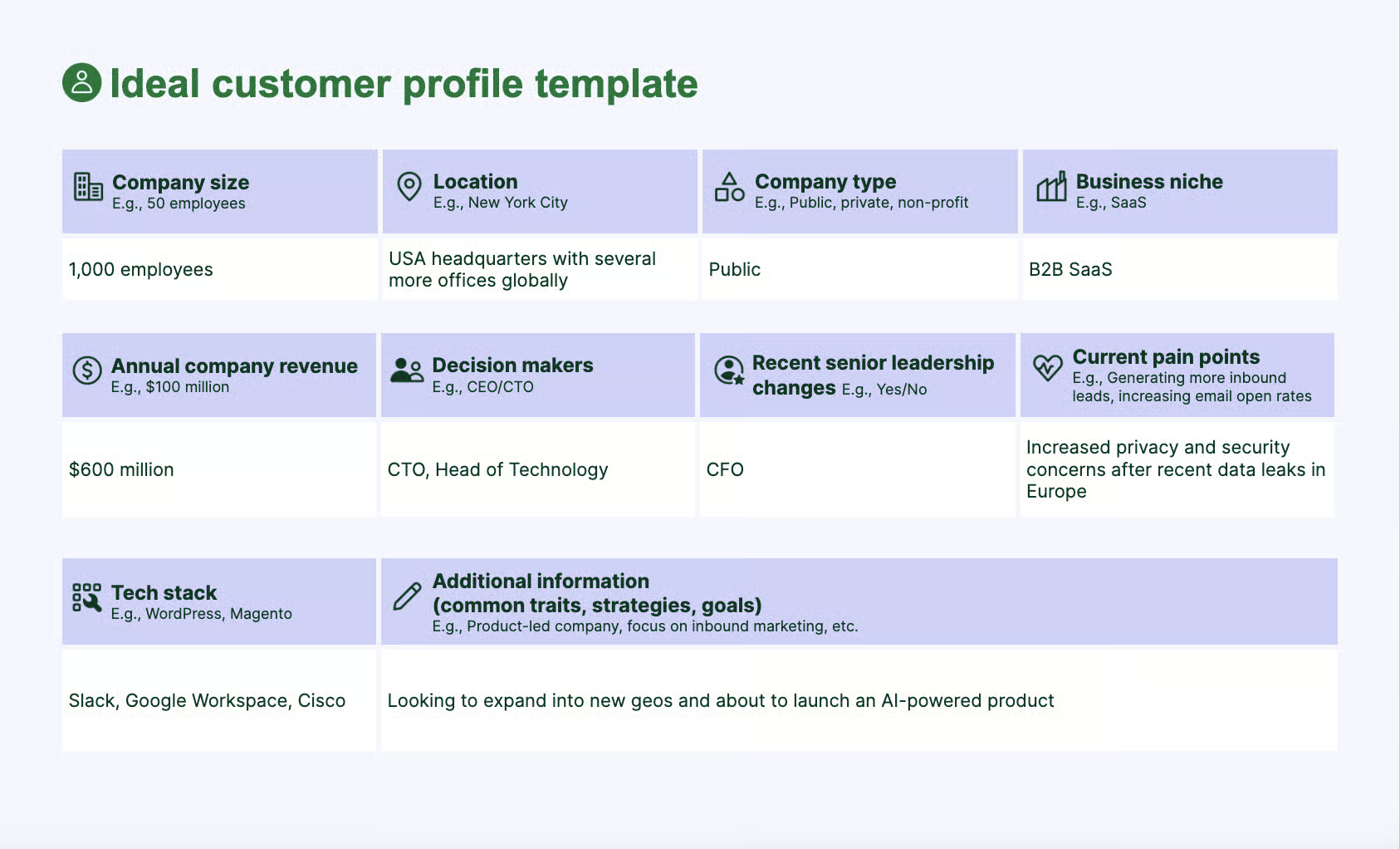

Ideal Customer Profile

Pipedrive excels for specific organizational contexts while proving inadequate for others.

Best suited for:

B2B sales teams with repeatable processes: Organizations following defined sales methodologies benefit from Pipedrive's structured approach to pipeline management and activity tracking.

Small to mid-size businesses: Companies with 5-50 sales representatives find the platform appropriately scaled—powerful enough for team coordination without enterprise complexity.

Short to medium sales cycles: Deals closing within days or weeks fit Pipedrive's velocity-focused design. The platform feels most natural when opportunities move frequently between stages.

Startups building initial sales systems: Organizations establishing their first formal CRM appreciate Pipedrive's approachability and minimal learning curve.

Teams prioritizing execution over analysis: Representatives spending more time selling than reporting benefit from Pipedrive's emphasis on activity over metrics.

Less appropriate for:

Organizations requiring post-sale workflow management: No native ticketing, onboarding, or customer success capabilities exist. Teams needing unified sales-through-service platforms should evaluate alternatives.

Marketing-driven organizations: Limited campaign management and lead nurturing capabilities make Pipedrive inadequate for marketing-focused teams.

Enterprise sales with complex cycles: Deals involving multiple stakeholders, approval chains, territory management, or quarter-long negotiations exceed Pipedrive's design parameters.

Budget-conscious solo users: The absence of free tiers makes Pipedrive less accessible than competitors offering permanent free plans for individual users.

Pipeline and Deal Management

Visual Board Experience

Pipedrive's defining feature remains its Kanban-style pipeline view. Deals display as cards arranged in columns representing sales stages. Moving opportunities between stages happens through simple drag-and-drop gestures.

During testing, we configured three separate pipelines—inbound leads, outbound prospecting, and expansion opportunities. Each pipeline supported unique stage definitions, probability assignments, and automation triggers. Switching between pipelines happened instantly through simple dropdown selection.

Deal cards surface essential information without opening records: company name, contact, deal value, expected close date, and days since last activity. This information density enables rapid pipeline review—we could assess 40+ opportunities in under two minutes, immediately identifying which required attention.

The "rotting deal" feature provides particular value. Deals untouched beyond defined timeframes display visual indicators (color changes, icons) flagging neglect. This passive accountability mechanism prevents opportunities from languishing forgotten.

Deal Detail Views

Clicking any deal card reveals comprehensive detail views organized through intuitive tabs:

Summary tab: Core deal information including value, stage, expected close date, assigned owner, associated contacts and organizations, and custom field values.

Activity timeline: Chronological display of all interactions—completed calls, sent emails, scheduled meetings, logged notes. When email integration is active, full message threads appear automatically without manual logging.

Files and documents: Centralized storage for proposals, contracts, presentations, and supporting materials associated with specific deals.

Participants: Multiple contacts can link to single deals, clarifying which stakeholders participate in purchase decisions.

Products: Line-item tracking for multi-product deals with quantity and pricing management.

Navigation between these views felt efficient during testing. Information appeared logically organized without excessive clicking to locate specific details.

Customization and Flexibility

Pipeline customization happens through straightforward editors. Adding stages requires only naming them and optionally assigning win probability percentages. Stages can be reordered through drag-and-drop, and unused stages delete instantly.

Each deal supports extensive customization through custom fields. We added fields tracking competitor presence, decision criteria, approval requirements, and technical requirements. These fields appear prominently in deal summaries and enable sophisticated filtering and reporting.

However, the visual pipeline view itself offers limited filtering options. You cannot filter the Kanban board by deal owner, value range, or custom field values without switching to list views. This limitation proved frustrating during team meetings when we wanted to review specific representative pipelines or high-value opportunities.

Bulk actions also require list view switching. Operations like mass assignment, stage updates, or tagging necessitate abandoning the visual board temporarily—an unnecessary friction point given how central the pipeline view is to the entire experience.

Contact and Organization Management

Data Structure

Pipedrive organizes customer information through two primary record types: People (individual contacts) and Organizations (companies). These records link bidirectionally—contacts associate with parent organizations, and organizations display all linked contacts.

The relationship system proved intuitive during testing. Logging activities against contacts automatically appeared in linked organization timelines and vice versa. This connection ensured complete interaction visibility regardless of entry point.

Activity Timeline Integration

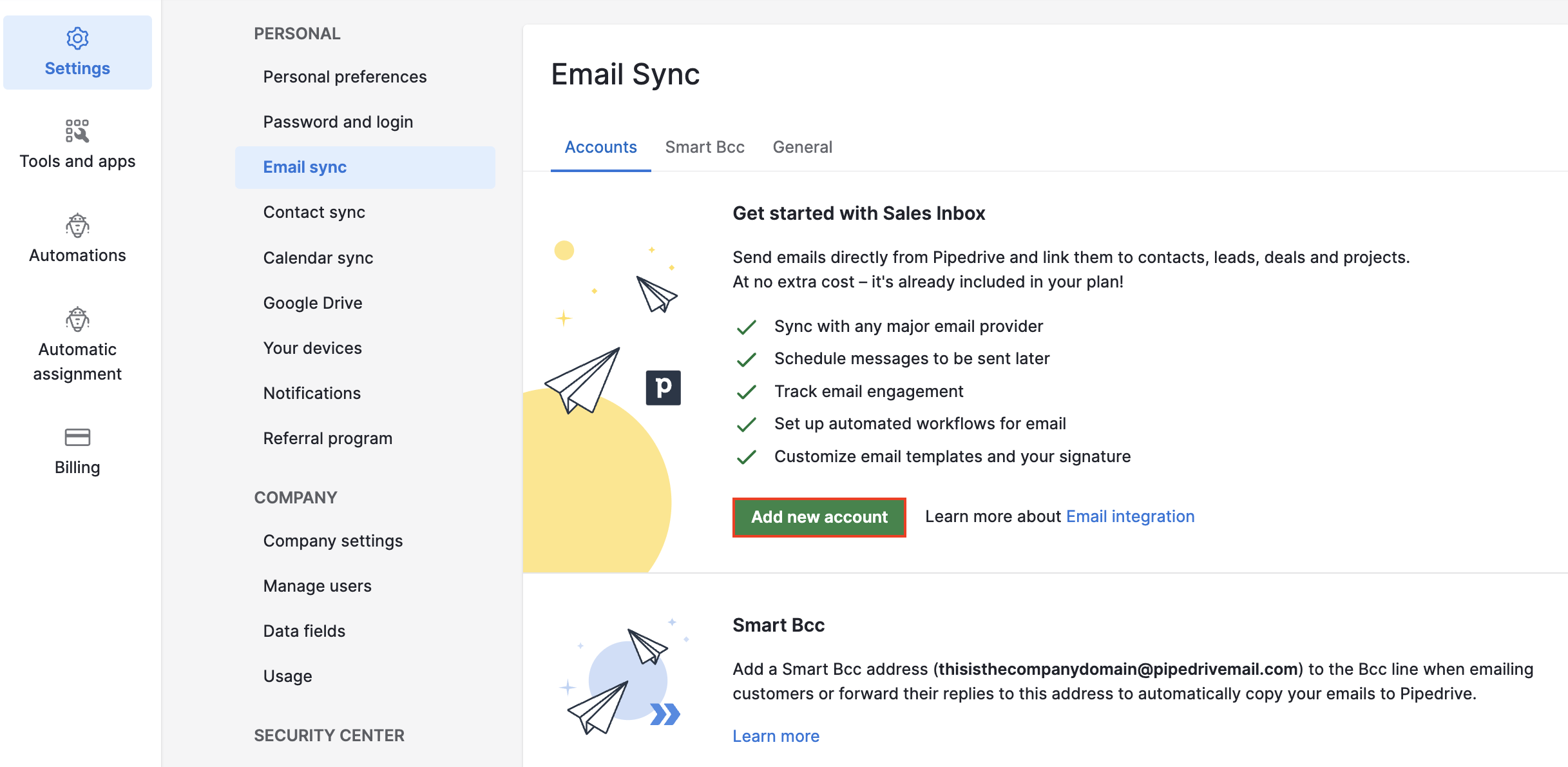

When email and calendar synchronization activates, Pipedrive automatically populates contact timelines with every interaction. During our Gmail integration testing, sent and received emails appeared within seconds of sending. Calendar meetings synchronized similarly, displaying appointment details, durations, and participant lists.

This passive activity logging eliminates the manual data entry burden plaguing many CRM implementations. Representatives simply conduct normal business communications, and Pipedrive captures everything automatically.

The timeline supports basic filtering by activity type (calls, emails, meetings, notes) but cannot filter by date ranges or specific users without exporting data. This limitation complicated historical analysis when reviewing long-term customer relationships.

Custom Field Implementation

Custom fields add easily through straightforward interfaces. We created fields for industry classification, employee count, revenue range, referral sources, and purchase authority level. Field types include text, numeric, monetary, date, single-select dropdowns, multi-select options, and people references.

Fields can be organized into custom sections, dramatically improving record readability when numerous fields exist. This organizational capability became essential once we exceeded 15 custom fields per record type.

During testing, we appreciated the field-level permission controls available in higher tiers. Sensitive information like discount approvals or contract terms could be restricted to specific team members while maintaining visibility of standard fields.

Duplicate Management Limitations

Duplicate detection proved disappointingly basic. Pipedrive flags potential duplicates during CSV imports based on exact email matches, but once records enter the system, no ongoing duplicate monitoring occurs.

We encountered this limitation after importing contacts from multiple sources. Three versions of the same person appeared—each with slightly different name formatting or email addresses. No automated merge suggestions surfaced, requiring manual identification and consolidation.

The platform lacks fuzzy matching algorithms detecting near-duplicates with minor variations. Organizations serious about data quality will need external deduplication tools or meticulous manual hygiene practices.

Lead Management and Automation

Lead Capture Mechanisms

Web forms: Pipedrive includes a native form builder enabling custom lead capture forms embeddable on websites. Fields map directly to contact properties and custom fields. Forms support basic validation and required field logic.

During testing, form submissions appeared in Pipedrive within seconds. Default assignment rules automatically routed leads to appropriate representatives based on configurable criteria.

However, forms lack conditional logic. Creating branching experiences based on previous answers requires external form builders with Pipedrive integration.

Lead Inbox: New leads flow into a dedicated staging area separate from main pipelines. This quarantine approach enables qualification before converting prospects to active opportunities. Representatives can bulk-assign leads, add qualification notes, or archive clearly unqualified prospects without polluting pipeline statistics.

The Lead Inbox concept proved valuable during testing. It prevented premature pipeline inclusion of unvetted contacts while maintaining centralized lead visibility.

LeadBooster add-on: This separately-purchased module adds chatbots, live chat, web visitor identification, and prospector databases. The chatbot operates through keyword-based conversation flows rather than sophisticated natural language processing.

We tested the chatbot with a qualification flow asking budget, timeline, and authority questions. Setup took approximately 30 minutes, and leads qualified through the bot arrived properly tagged with conversation context.

Workflow Automation Capabilities

Pipedrive's automation builder enables trigger-based workflows executing actions when specific conditions occur. Common triggers include deal stage changes, activity completion, and field value updates.

Available actions encompass task creation, owner assignment, deal stage changes, email sending, webhook calls, and notification dispatching.

During testing, we built automations for:

- Assigning new deals to representatives based on geographic territories

- Creating follow-up tasks when deals stagnate in specific stages

- Sending email sequences when deals enter nurture stages

- Notifying managers when high-value deals enter negotiation

These automations functioned reliably, executing within seconds of triggering conditions.

Critical limitation: The automation builder operates linearly without native support for if/then branching or conditional paths. Creating behavior variations based on field values requires building separate workflows for each scenario.

For example, sending different email sequences based on industry classification necessitates creating multiple workflows—one per industry—each with unique trigger conditions. This approach creates maintenance overhead and complicates troubleshooting.

Similarly, time-based delays or follow-up checks ("if contact hasn't responded in 3 days, do X") require workarounds through activity due dates rather than native workflow logic.

For straightforward sales automations, Pipedrive's capabilities suffice. Complex, multi-path workflows require external automation platforms like Zapier or Make.

AI and Intelligent Features

Smart Contact Enrichment

When adding new contacts or organizations with business email addresses, Pipedrive attempts automatic enrichment from public data sources. During testing, this feature successfully populated company names, websites, industry classifications, and employee counts approximately 70% of the time.

The enrichment happens passively without prompting verification. We encountered several instances where incorrect data populated due to domain confusion—particularly with companies sharing similar names or operating multiple brands under single domains.

No active deduplication occurs during enrichment. If multiple records exist for the same company, each gets enriched independently without consolidation suggestions.

Sales Assistant

The Sales Assistant operates as a persistent sidebar panel surfacing alerts and suggestions based on pipeline activity patterns. It flags:

- Deals untouched beyond specified timeframes

- Overdue activities requiring completion

- Opportunities showing engagement decline

- Recommended best practices (template creation, automation opportunities)

During testing, these nudges proved timely and genuinely useful. The assistant caught several deals we'd inadvertently neglected during busy periods, preventing potential losses.

However, prioritization remains simplistic. The assistant treats all flagged deals equally regardless of value or close probability. A $500 opportunity receives identical urgency as a $50,000 deal. Representatives managing complex portfolios still need to apply personal judgment about priority sequencing.

Limitations in Predictive Intelligence

Pipedrive's AI capabilities remain fundamentally reactive rather than predictive. The platform doesn't:

- Score leads based on conversion likelihood

- Forecast deal close probabilities beyond manual stage assignments

- Suggest optimal next actions based on historical success patterns

- Identify at-risk opportunities before they stall

Organizations seeking sophisticated predictive analytics or AI-driven coaching will find Pipedrive's intelligence features inadequate. The platform helps prevent oversight but doesn't guide strategic decision-making.

Email Integration and Communication

Synchronization Quality

Gmail and Outlook integration worked flawlessly during extended testing. Email synchronization happened bidirectionally within seconds:

- Outbound emails sent from Pipedrive appeared in Gmail sent folders immediately

- Emails sent through Gmail to contacts in Pipedrive logged automatically to contact timelines

- Thread continuity maintained across platforms without duplicates

- Calendar meetings synchronized similarly with full participant and description details

This seamless integration eliminates the frustrating context-switching and manual logging plaguing many CRM implementations.

Email Tracking and Templates

Pipedrive tracks email opens and link clicks when messages send through the platform. During testing, tracking data appeared reliably, showing exact open timestamps and clicked links.

Email templates support merge fields pulling contact and deal information dynamically. We created templates for introduction messages, follow-up sequences, meeting confirmations, and proposal transmittals. Template usage significantly accelerated routine communications.

However, template management becomes cumbersome with large libraries. No folder organization or tagging system exists for categorizing templates, making location increasingly difficult as template counts grow.

Email Sequences

Higher-tier plans include email sequence capabilities enabling multi-touch campaigns. Sequences support:

- Multiple emails with defined delays between messages

- Automatic sending when contacts enter sequences

- Pause conditions when contacts reply

- Tracking of sequence performance metrics

We tested a three-email introduction sequence for cold outreach. Setup proved straightforward, and messages dispatched reliably according to defined schedules. Reply detection worked correctly, preventing awkward continued sending after engagement.

The limitation: sequences operate independently of broader automation workflows. Integrating sequence enrollment with deal stage changes or field value updates requires manual workarounds or external automation platforms.

Integration Ecosystem

Native Connections

Pipedrive offers native integrations with commonly-used business tools:

Email and calendar: Gmail, Google Workspace, Microsoft 365, Outlook, Exchange

Communication: Slack, Microsoft Teams, Zoom, Google Meet

Documentation: PandaDoc, DocuSign, HelloSign

Accounting: QuickBooks, Xero

Project management: Trello, Asana, monday.com

Marketing: Mailchimp, ActiveCampaign

During testing, we activated Gmail, Google Calendar, Zoom, and Slack integrations. All established connections within minutes and functioned reliably without configuration issues.

Email and calendar syncing worked perfectly as previously discussed. Zoom integration enabled meeting scheduling directly from Pipedrive with automatic calendar blocking and join link generation. Slack integration posted notifications when deals moved stages or activities completed.

Integration Depth Limitations

While native integrations connect reliably, functionality depth varies. For example:

Zoom integration enables meeting scheduling and launching but doesn't capture recordings, transcripts, or post-call analytics automatically. These require manual upload or separate integration workflows.

Accounting integrations create invoices from deal records but don't support bidirectional payment status syncing or receivables tracking.

Documentation platforms generate contracts from templates but require switching to external platforms for signature workflows and document management.

These limitations mean Pipedrive serves as activity hub rather than comprehensive system of record. Organizations still need dedicated platforms for many business functions with Pipedrive coordinating rather than replacing them.

Marketplace and Third-Party Extensions

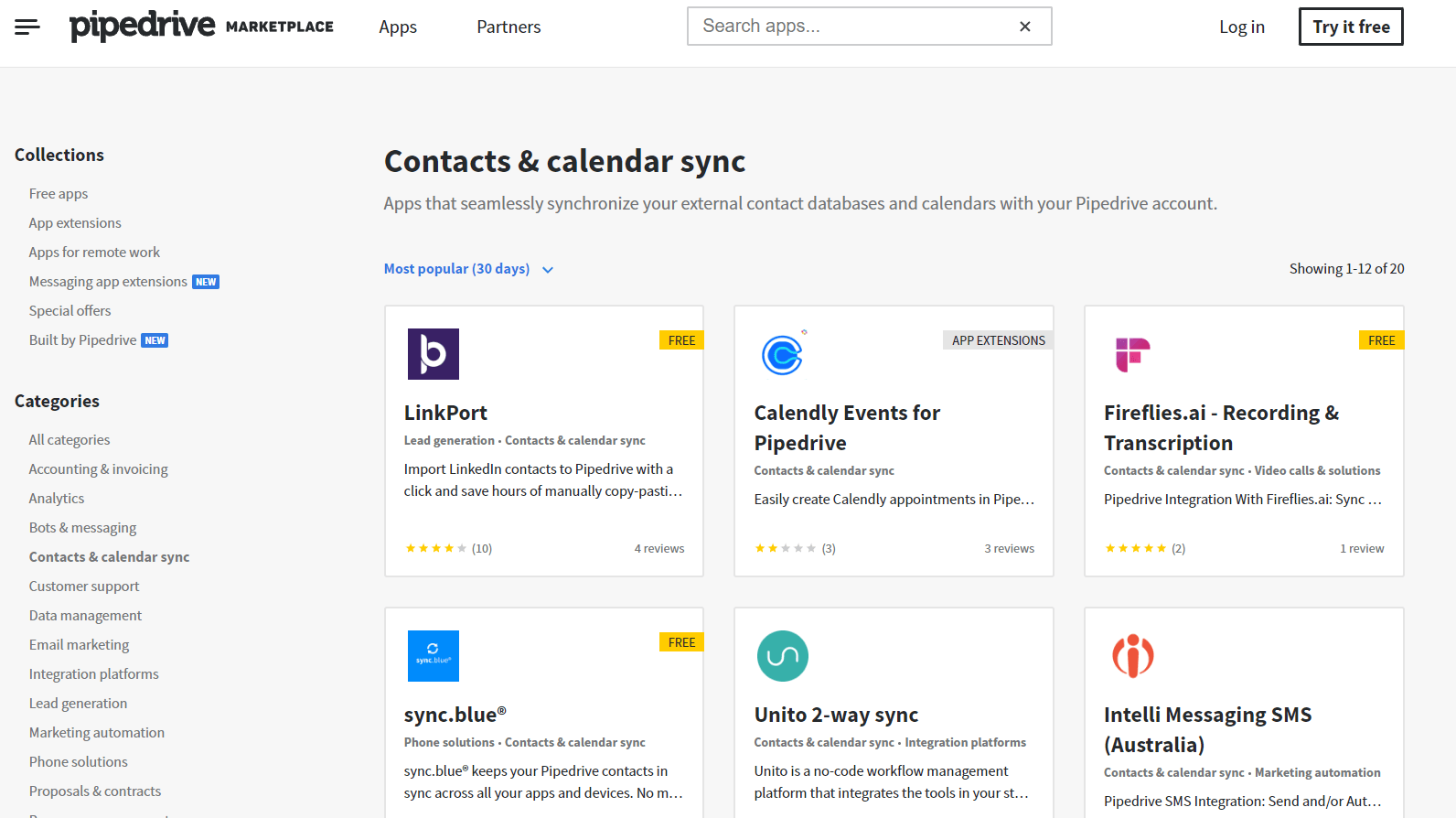

The Pipedrive Marketplace contains over 400 integrations spanning diverse categories—phone systems, marketing automation, help desks, data enrichment, analytics, and specialized industry tools.

We tested several marketplace applications:

Phone integration (JustCall): Added click-to-call capabilities with automatic call logging. Setup required 15 minutes and API credential exchange. Functionality worked reliably once configured.

Prospecting tool (Apollo.io): Enabled contact discovery and enrichment. Integration quality impressed—discovered contacts flowed directly into Pipedrive with complete information.

Marketing automation (ActiveCampaign): Connected email marketing campaigns to CRM contacts. However, setup complexity increased significantly compared to native integrations, requiring field mapping and webhook configuration.

Automation Platform Flexibility

Pipedrive connects well with automation platforms like Zapier, Make (Integromat), and Tray.io, enabling custom workflows beyond native capabilities.

We built several Zapier automations during testing:

- Slack notifications when deals exceed value thresholds

- Google Sheets logging for backup and analysis

- Custom email alerts to executives for strategic deal updates

These automations extended Pipedrive's native capabilities effectively, though they introduce additional subscription costs and complexity.

Reporting and Analytics

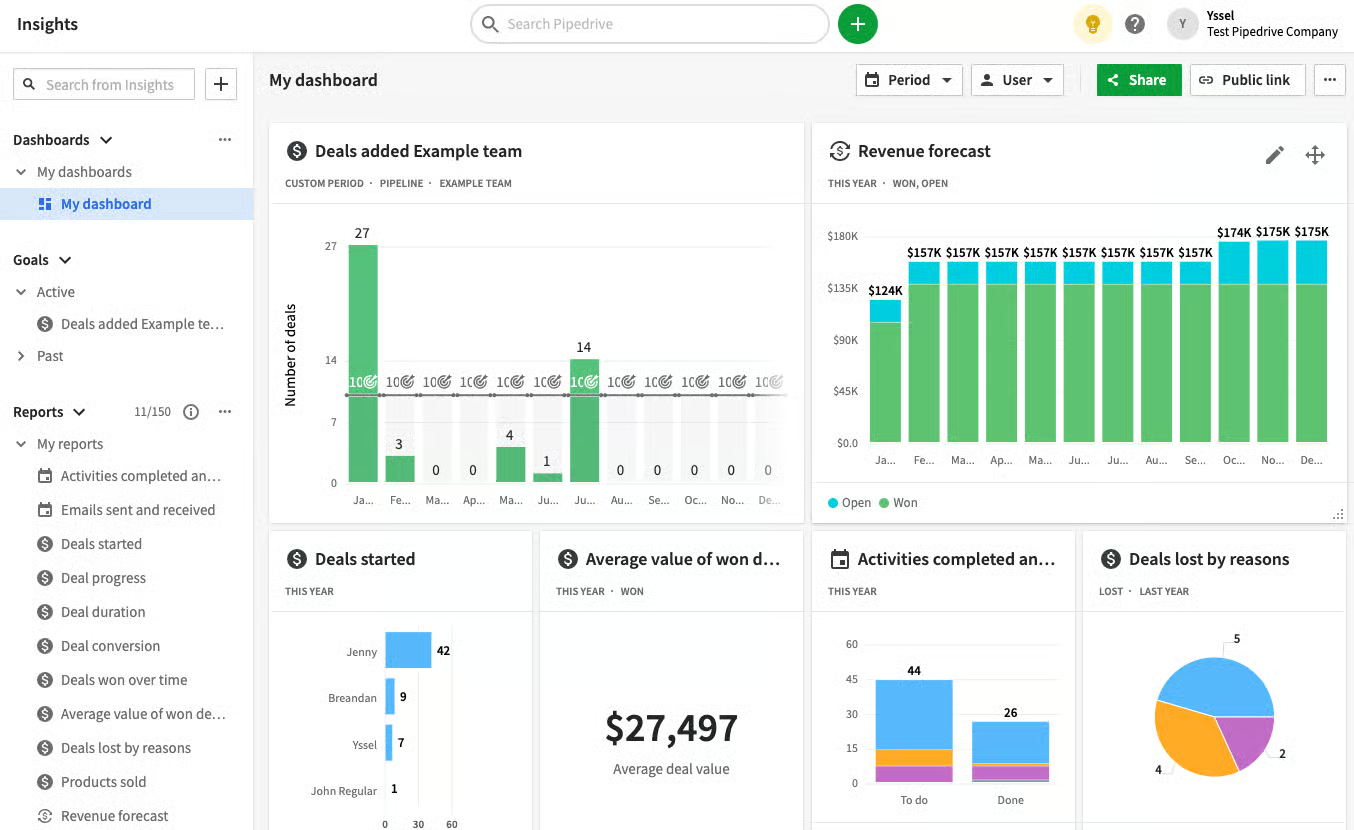

Standard Reporting Capabilities

Pipedrive includes basic reporting across several categories:

Deals reporting: Pipeline value by stage, conversion rates between stages, average deal size, deal velocity (time between stages)

Activities reporting: Completed activities by type and representative, activity-to-deal ratios, overdue activity tracking

Forecasting: Expected revenue by period based on deal values and expected close dates

Performance dashboards: Representative rankings by activities completed, deals closed, and revenue generated

During testing, these reports provided sufficient visibility for daily sales management. We could quickly identify:

- Which pipeline stages accumulated bottlenecks

- Which representatives required coaching due to activity shortfalls

- Which deals required urgency based on expected close dates

- Revenue forecasts for upcoming periods

Report generation happened quickly, and visualizations (bar charts, line graphs, pie charts) clearly communicated key metrics.

Limitations for Advanced Analysis

Report customization constraints became apparent when seeking deeper insights:

Limited filtering: Many reports cannot filter by custom field values, requiring data exports for advanced segmentation

No cross-object reporting: Cannot create reports combining deal, activity, and contact data in single views without external tools

Basic time period options: Some reports lack flexible date range selection, supporting only predefined periods (this month, this quarter)

Export limitations: Lower tiers restrict report access and export capabilities

No scheduled delivery: Reports don't automatically email to stakeholders on schedules without third-party automation

Organizations requiring sophisticated analytics, custom dashboards, or executive reporting will find Pipedrive's native capabilities insufficient. These use cases typically necessitate:

- Exporting data to Business Intelligence platforms (Tableau, Power BI, Looker)

- Building custom dashboards through API access

- Purchasing third-party analytics add-ons

For typical small to mid-size sales teams, native reporting proves adequate. Enterprise organizations or metrics-driven sales cultures will quickly encounter limitations.

Pricing Structure and Value Analysis

Plan Tiers and Capabilities

Essential ($14/user/month, annual billing):

- Core pipeline and deal management

- Contact and organization records (30 custom fields max)

- Basic reporting (15 reports per user)

- Calendar sync

- 500+ integration access

- Email support

Excludes: Email sync, automation, lead inbox, AI assistant

Advanced ($34/user/month, annual billing):

- Everything in Essential

- Full email integration with tracking

- Lead Inbox for qualification

- Workflow automation (50 per company)

- AI Sales Assistant

- Custom fields increase to 100

- Live chat support

Excludes: Advanced permissions, contract management, premium integrations

Professional ($49/user/month, annual billing):

- Everything in Advanced

- LeadBooster included (chatbot, live chat, forms, prospector)

- Smart Docs for proposals and e-signatures

- Enhanced automation (150 per company)

- Team management features

- Custom fields increase to 300

- Priority support

Excludes: Enterprise security features, advanced data controls

Power ($64/user/month, annual billing):

- Everything in Professional

- Advanced permissions and team controls

- Data validation and enrichment

- Sandbox environment for testing

- Enhanced API limits

- 24/7 phone support

- Custom fields increase to 500

- Automation limit increases to 250

Enterprise ($99/user/month, annual billing):

- Everything in Power

- Unlimited pipelines, custom fields, and dashboards

- Dedicated account manager

- Advanced security features

- Audit logs and compliance tools

- Faster support response times

Add-On Pricing

Several valuable capabilities require separate purchases beyond base plans:

LeadBooster: $32.50/month (included in Professional tier and above) Campaigns: Email marketing module, $13.33/month Web Visitors: Anonymous visitor tracking, from $41/month Projects: Lightweight project management, $6.67/month

Value Assessment

Best value tier: The Advanced plan ($34/user/month) represents the optimal balance for most organizations. Email sync, automation, and the AI Assistant transform Pipedrive from basic pipeline tracker to functional sales platform.

The Essential tier feels too limited for serious use—lacking email integration severely hampers productivity. Professional tier ($49/user/month) adds significant value through LeadBooster and Smart Docs, justifying the upgrade for teams actively generating leads and sending proposals.

Power and Enterprise tiers target larger organizations requiring advanced permissions, security controls, and premium support. Most small to mid-size teams won't require these capabilities.

Compared to competitors:

At $34/user/month, Pipedrive's Advanced plan prices competitively with:

- HubSpot Sales Hub Starter ($15/user/month, but limited features)

- Zoho CRM Standard ($14/user/month, comparable capabilities)

- Freshsales Growth ($15/user/month, similar feature set)

Pipedrive costs more than some alternatives but delivers superior pipeline visualization and user experience. Organizations prioritizing intuitive interfaces over feature breadth often find the premium worthwhile.

Getting Started: Implementation Guide

Trial Strategy

Pipedrive offers 14-day free trials on all plans without requiring credit cards. We recommend starting with the Advanced tier trial as it unlocks email sync, automation, and AI assistance—capabilities essential for evaluating whether Pipedrive genuinely fits your needs.

Implementation Sequence

Week 1: Foundation (Days 1-3)

- Configure pipelines: Create 1-2 pipelines matching your actual sales process. Define stages realistically—don't overthink or create excessive stages initially.

- Import contact data: Start with 20-50 real contacts and deals representing active opportunities. Use actual data, not hypothetical examples.

- Connect email and calendar: Activate Gmail or Outlook sync immediately. This connection determines whether Pipedrive's core value proposition—automatic activity logging—works for your environment.

- Customize fields: Add 5-10 custom fields capturing information critical to your sales process but not included in standard fields.

Week 1: Automation (Days 4-7)

- Build first automation: Create a simple workflow assigning new deals to representatives based on territory or deal size. This tests whether automation logic matches your needs.

- Set up email templates: Create 3-5 templates for common communications—introductions, follow-ups, meeting requests. Template usage significantly accelerates daily work.

- Configure web form: Build and embed a basic lead capture form. Test submission flow from website through Lead Inbox to pipeline conversion.

Week 2: Validation (Days 8-14)

- Execute real workflows: Use Pipedrive for all sales activities during this period. Log calls, send emails, move deals, complete tasks—everything.

- Monitor team adoption: If multiple representatives are testing, observe whether they naturally use Pipedrive or avoid it. Voluntary adoption indicates good fit.

- Assess friction points: Note where workflows feel awkward, require excessive clicks, or create confusion. These friction points reveal whether Pipedrive matches how your team actually works.

- Evaluate integration quality: Verify email/calendar sync reliability, test any third-party integrations critical to your stack, and confirm data flows correctly.

- Review reporting: Generate pipeline reports, activity summaries, and forecasts. Determine whether native reporting meets your visibility needs or requires external tools.

Decision Criteria

After two weeks, evaluate against these criteria:

Pipeline clarity: Can representatives instantly understand deal status and priorities from pipeline views?

Activity capture: Does automatic logging work reliably, or do gaps require manual effort?

Workflow efficiency: Do common tasks (creating deals, logging calls, sending emails) feel fast and natural?

Adoption enthusiasm: Are team members choosing to use Pipedrive, or do they require constant reminders?

Missing capabilities: Are absent features (e.g., branching automation, advanced reporting) dealbreakers or minor inconveniences?

If Pipedrive feels like it lightens representative workload while improving visibility, commit to a subscription. If it creates new friction or doesn't materially improve on existing approaches, explore alternatives.

Alternatives Worth Considering

HubSpot CRM

Best for: Organizations wanting integrated marketing and sales platforms

HubSpot offers more comprehensive capabilities across marketing, sales, and service. The free tier provides genuine functionality, and paid plans support sophisticated workflows, advanced reporting, and deep customization.

Trade-offs: HubSpot's breadth creates complexity. The platform can feel overwhelming compared to Pipedrive's focused simplicity. Pricing also escalates quickly as feature needs grow.

Zoho CRM

Best for: Budget-conscious teams needing extensive customization

Zoho delivers remarkable capability depth at attractive price points. Automation supports complex branching logic, reporting is highly customizable, and the platform scales effectively.

Trade-offs: Interface density and configuration complexity create steeper learning curves than Pipedrive. Setup requires more time investment, and some users find the UI cluttered.

Salesforce Sales Cloud

Best for: Enterprise organizations with complex sales processes

Salesforce provides unmatched customization, sophisticated territory management, comprehensive forecasting, and extensive integration ecosystems.

Trade-offs: Salesforce demands significant configuration expertise and administrative resources. Implementation complexity and cost make it impractical for most small to mid-size organizations.

Close CRM

Best for: High-velocity inside sales teams

Close consolidates calling, texting, and emailing into unified interfaces. Built-in communication tools eliminate integration needs, and the platform excels at managing high-volume outreach.

Trade-offs: Pipeline visualization is basic compared to Pipedrive, and the platform lacks visual polish. Organizations prioritizing pipeline clarity over communication density may prefer Pipedrive.

Copper CRM

Best for: Google Workspace power users

Copper embeds directly into Gmail, providing native CRM functionality within existing email workflows. For teams living in Google apps, the integration quality is unmatched.

Trade-offs: The platform assumes Google Workspace usage—Outlook users find Copper inadequate. Pipeline features and reporting also lag behind dedicated CRM platforms like Pipedrive.

Final Assessment

What Pipedrive Does Exceptionally Well

Visual pipeline management: The Kanban-style board remains the most intuitive pipeline interface we've tested. Deal status and movement are immediately obvious without reports or queries.

Activity-based selling: Constant emphasis on next actions and follow-ups prevents opportunity neglect. The system keeps representatives focused on execution rather than administration.

Email integration quality: Seamless bidirectional sync with Gmail and Outlook eliminates manual logging friction plaguing many CRM implementations.

Rapid deployment: Most teams achieve productivity within hours of initial setup. The learning curve is minimal compared to enterprise alternatives.

Focused scope: Deliberate feature restraint prevents overwhelming complexity. Representatives can master Pipedrive completely rather than using fraction of sprawling platforms.

Where Pipedrive Falls Short

No free tier: The absence of permanent free plans limits accessibility compared to HubSpot, Zoho, and others offering perpetual free access.

Linear automation: Workflow builders lack sophisticated branching logic, requiring external automation platforms for complex scenarios.

Limited post-sale support: No native ticketing, onboarding, or customer success capabilities exist. Organizations requiring unified sales-through-service platforms need different solutions.

Basic reporting: Native analytics suffice for most teams but lack depth enterprise organizations and metrics-driven cultures require.

Add-on costs: Many valuable features (campaigns, web visitor tracking, enhanced lead generation) require separate purchases beyond base subscriptions.

Who Should Choose Pipedrive

Pipedrive represents the optimal choice for:

- B2B sales teams with 5-50 representatives following defined sales processes

- Organizations with short to medium sales cycles (days to weeks, not quarters)

- Teams prioritizing execution over analysis who spend more time selling than reporting

- Startups and SMBs building initial sales systems without dedicated CRM administrators

- Representatives frustrated by CRM complexity who want tools that feel helpful rather than burdensome

Who Should Look Elsewhere

Consider alternatives if you:

- Require comprehensive marketing automation beyond basic email campaigns

- Need customer service and support ticketing integrated with sales workflows

- Manage complex enterprise sales cycles with territory management and approval chains

- Want sophisticated predictive analytics and AI-driven sales coaching

- Operate as solo user on tight budget preferring platforms with permanent free tiers

Common Questions About Pipedrive

Does Pipedrive work for complex B2B sales?

It depends on your definition of "complex." Pipedrive handles multi-stakeholder deals, long follow-up sequences, and detailed opportunity tracking effectively. However, it lacks enterprise features like territory management, approval workflows, and sophisticated forecasting models.

Organizations with sales cycles exceeding 3-6 months or requiring formal approval chains typically outgrow Pipedrive, necessitating platforms like Salesforce or Microsoft Dynamics.

Can teams implement Pipedrive without technical expertise?

Yes. Pipedrive is among the most accessible CRM platforms available. Most organizations complete initial setup within 2-4 hours without external assistance.

However, advanced scenarios—complex integrations, sophisticated automations spanning multiple platforms, API development—may require technical resources or consulting support.

How does Pipedrive compare to HubSpot?

Pipedrive advantages: Cleaner interface, superior pipeline visualization, faster initial setup, lower starting price for core sales functionality.

HubSpot advantages: Free tier available, integrated marketing capabilities, more sophisticated automation logic, deeper reporting and analytics, comprehensive service hub.

Choose Pipedrive if you prioritize sales execution and visual simplicity. Choose HubSpot if you need integrated marketing or plan to scale into comprehensive revenue operations platform.

What happens to data after trial expiration?

Data remains intact but becomes read-only if you don't subscribe. You can export contacts, deals, and activities, but cannot create records or use automations without active subscription.

Reactivating subscriptions after cancellation restores full functionality immediately.

Is Pipedrive suitable for solo entrepreneurs?

Functionally yes—the platform works well for individual users. However, the lack of free tier and $14/user/month minimum makes it relatively expensive compared to alternatives like HubSpot (free forever) or Zoho (free for 3 users).

Solo entrepreneurs should exhaust free alternatives before committing to Pipedrive subscriptions unless the visual pipeline interface specifically addresses critical pain points.

Can Pipedrive replace spreadsheet-based sales tracking?

Absolutely. Pipedrive provides dramatically superior visibility, automation, and collaboration compared to spreadsheet approaches while remaining nearly as simple to use.

The primary caveat: spreadsheets offer unlimited customization and zero recurring costs. Teams with extremely unique workflows or zero software budget might stick with spreadsheets, but most organizations benefit substantially from migrating to proper CRM platforms like Pipedrive.

Conclusion

Pipedrive succeeds by embracing focused simplicity in a CRM landscape dominated by feature sprawl. The platform doesn't attempt to be everything to everyone—it concentrates on visual pipeline management and activity-based selling, executing these core functions exceptionally well.

For B2B sales teams wanting clear deal visibility, reliable email integration, and straightforward automation without overwhelming complexity, Pipedrive delivers meaningful value. The intuitive interface, rapid deployment, and emphasis on execution over administration make it particularly well-suited for small to mid-size organizations and fast-moving startups.

However, Pipedrive's deliberate focus creates natural boundaries. Organizations requiring marketing automation, customer service integration, sophisticated forecasting, or complex workflow logic will quickly encounter limitations necessitating either add-on purchases or alternative platforms.

The decision ultimately depends on your priorities: If pipeline clarity and sales execution matter most, Pipedrive likely represents your best choice. If comprehensive platform capabilities outweigh interface elegance, explore alternatives offering broader functionality despite steeper learning curves.

Test Pipedrive through the 14-day trial using real data and workflows. The platform's suitability becomes obvious quickly—you'll either appreciate the focused simplicity or recognize the absent features are dealbreakers. Trust that assessment more than any review.