What is CRM in private equity?

Customer Relationship Management, or CRM, is an important part of private equity firms' operations. It includes the management and analysis of interactions with portfolio companies, investors, and other contacts to elevate deal performance and strengthen client connections.

Private equity firms rely on CRM solutions to centralize key data, including asset classes, fundraising processes, deal sources, and client interactions. This consolidated information is key for asset management strategies and offers a comprehensive view of a firm's sales pipeline and valuation trends. By automating manual tasks like data entry, private equity CRM software enables firms to streamline operations and prioritize other activities.

Moreover, these CRM solutions seamlessly integrate with external data providers to enrich the quality and depth of essential information. They give invaluable insights into crucial relationships, aiding private equity firms in establishing an integrated platform for investor relations management.

[Related article: 8 Best CRM for Financial Advisors (Wealth Management) in 2024]

Below, you can see these top-rated CRM software to boost your sales and marketing efforts, and relationships with customers:

Fireberry

By using Fireberry, you can easily manage all your business needs with a user-friendly system. Your unique business deserves a platform built just for you, so you can maximize your time and productivity where it matters most.

-Mar-27-2024-12-45-00-9156-PM.png)

Zoho

It is a web-based email marketing management service for small and medium businesses. It automates the entire marketing process - from managing your email marketing campaign to maintaining mailing lists.

-Mar-27-2024-12-45-09-7283-PM.png)

Pipedrive

Pipedrive CRM is a user-friendly platform that is effortless to master. It is the creative web designer's secret weapon in the world of Customer Relationship Management.

-Mar-27-2024-12-45-07-2388-PM.png)

monday sales CRM

Let monday sales CRM do the grunt work while your team stays focused on high-level tasks, such as creative projects, business strategy, and relationship building.

What to look for when choosing CRM software for private equity?

When considering the best CRM for private equity, it's crucial to prioritize solutions tailored to the specific needs of investors, traders, and accountants, accommodating long deal cycles and diverse investment contact types. Here's what the ideal private equity CRM should offer:

1. End-to-end Deal Management

Comprehensive deal management capabilities, like those found in Salesforce, are customized to handle potential acquisitions, target evaluation, and due diligence processes. A robust CRM should provide a clear overview of every stage of the deal, enabling efficient tracking and management.

2. Tracking of Private Equity Metrics

Functionality for tracking essential metrics such as liquidity, MOIC, cash flow, expense control, IRR, customer lifetime value, and industry-related metrics within a single system. The ability to monitor these metrics facilitates data-driven decision-making and ensures a holistic understanding of investment performance.

3. Robust Visualization and Dashboards

Flexible and customizable visualization tools and dashboards enable the capture, analysis, and visualization of investment data. Visual representations offer insights into trends, patterns, and performance metrics, empowering users to make informed decisions.

4. Relationship Databases

Centralized management of relationship databases for investors, portfolio companies, and stakeholders, offering tools for maintaining detailed profiles, tracking communications, and strategic decision-making through relationship mapping features. Effective relationship management strengthens connections and fosters collaboration within the private equity ecosystem.

5. Collaboration Tools

Seamless interconnectivity across teams ensures consistent messaging and access to past communications with clients and partners to avoid conflicting information. Collaboration tools facilitate efficient communication, coordination, and alignment across departments and stakeholders.

6. 3rd-Party Data & App Integration

Flexibility to integrate with various systems and data sources, such as Outlook, Gmail, Preqin, and Pitchbook, accommodating diverse preferences and needs. Integration capabilities enhance data accessibility and streamline workflows by consolidating information from multiple sources.

7. Scalability

Customizable and flexible CRM solutions capable of scaling alongside the business offer adaptability to changes in the firm's size and requirements without outgrowing the software. Scalability enables seamless expansion and growth while maintaining operational efficiency and effectiveness.

8. Customization

Ability to customize dashboards, client profiles, and reporting tools to align with specific investment processes, providing flexibility and optimization for private capital investors. Customization options empower users to tailor the CRM system to their unique workflows and preferences, enhancing usability and productivity.

[Related article: Mastering the Art of Efficient Account Payables Management in 10 Expert-Backed Tips]

CRM Choice for the Education Industry

4.4

Benefits of CRM systems for private equity

Private equity (PE) firms stand to gain numerous advantages from adopting CRM solutions:

- Efficient Deal Flow Management: With a constant influx of potential investments, PE firms rely on CRM systems to effectively track and manage opportunities, ensuring no valuable deal goes unnoticed.

- Streamlined Relationship Management: Dealing with diverse stakeholders requires effective communication and relationship tracking. CRM systems consolidate conversations, making interactions secure and easily accessible. This fosters personalized engagements and identifies key introductions.

- Enhanced Productivity: By eliminating the need for manual data gathering, CRM enables investment professionals to focus on critical tasks, enhancing productivity and accelerating workflow progression.

- Informed Decision-Making: Centralizing data from investors, portfolio companies, and stakeholders empowers managing directors to make well-informed evaluations and choices. Access to real-time information also streamlines due diligence processes, facilitating quicker decision-making.

- Proactive Risk Management: CRM platforms offer insights into portfolio company performance, aiding in risk assessment and ensuring compliance with regulatory requirements. This reduces manual effort and enhances regulatory compliance.

- Advanced Progress Tracking: Leveraging sophisticated analytics and reporting features, CRM software provides comprehensive insights into deal progress and performance metrics, facilitating data-driven decision-making and strategic planning.

- Seamless Onboarding: With consolidated data in one accessible location, CRM simplifies the onboarding process for new clients and employees, ensuring smooth transitions and effective integration into the firm's operations.

[Related article: What Is Management of Accounts Receivable? 10 Ways to Improve The Process]

10 best CRM systems private equity

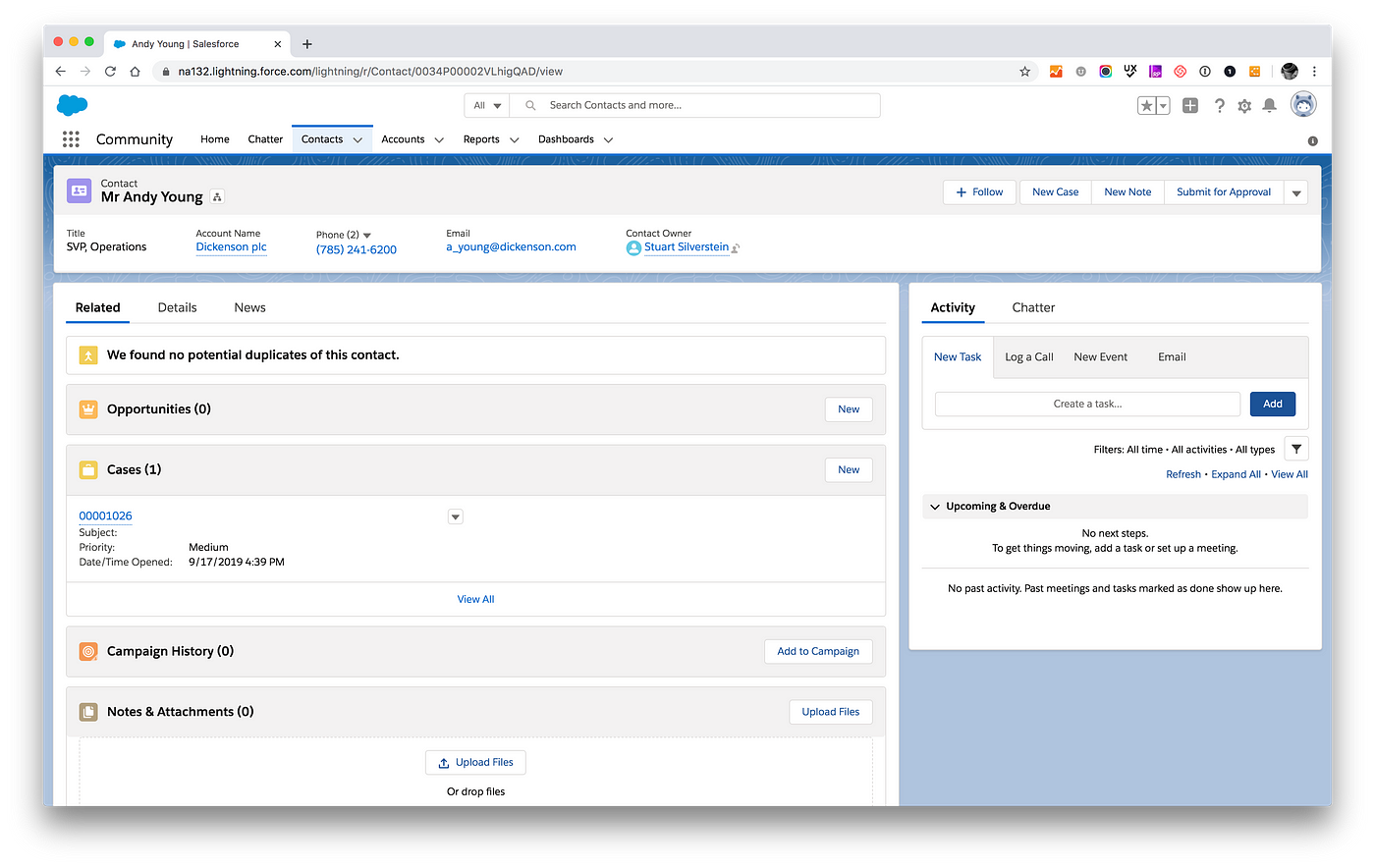

1. Salesforce

Salesforce, a leading CRM software company, delivers cloud-based solutions tailored to businesses across various industries and sizes. Offering a comprehensive suite of tools, Salesforce empowers organizations to optimize customer interactions and streamline business processes effortlessly.

Key Features:

- Investor Relationship Management (IRM): Dedicated functionalities for managing investor relations, tracking commitments, and monitoring investor engagement.

- Deal Management: Tools for efficient deal tracking, evaluation, and management throughout the deal lifecycle.

- Fund Management: Centralized platform for managing fund-related activities, including fundraising, allocation, and performance tracking.

- Portfolio Management: Robust portfolio management tools to monitor and analyze portfolio performance, track investments, and assess returns.

- Reporting Functionality: Extensive reporting capabilities to generate customized reports and gain insights into key metrics and performance indicators.

- Customization Options: Flexible customization options to adapt workflows, interfaces, and data structures to specific business requirements.

- Integration Capabilities: Seamless integration with other software applications such as accounting, portfolio management, and document management systems for enhanced efficiency and collaboration.

Pros:

- Salesforce provides Sales Cloud, Service Cloud, and Pardot, catering specifically to the needs of private equity firms.

- A wide range of features include investor relationship management (IRM), deal management, fund management, portfolio management, and reporting capabilities.

- Unlimited customization workflows and interfaces.

- High-security standards to safeguard your sensitive data.

- Interactive dashboards powered by AI uncover valuable insights and data patterns.

Cons:

- Salesforce may be costly, particularly for small businesses.

- Limitations with out-of-the-box reporting tools.

- Effective utilization of Salesforce often necessitates skilled administrators or developers, adding complexity.

- Depending on your business operations, additional field development or account types (LP / GP / intermediary) may be necessary.

Pricing:

Pricing depends on the chosen Salesforce Cloud.

[Related article: 9 Best Accounting CRM Software for Bookkeepers and CPA Firms in 2024]

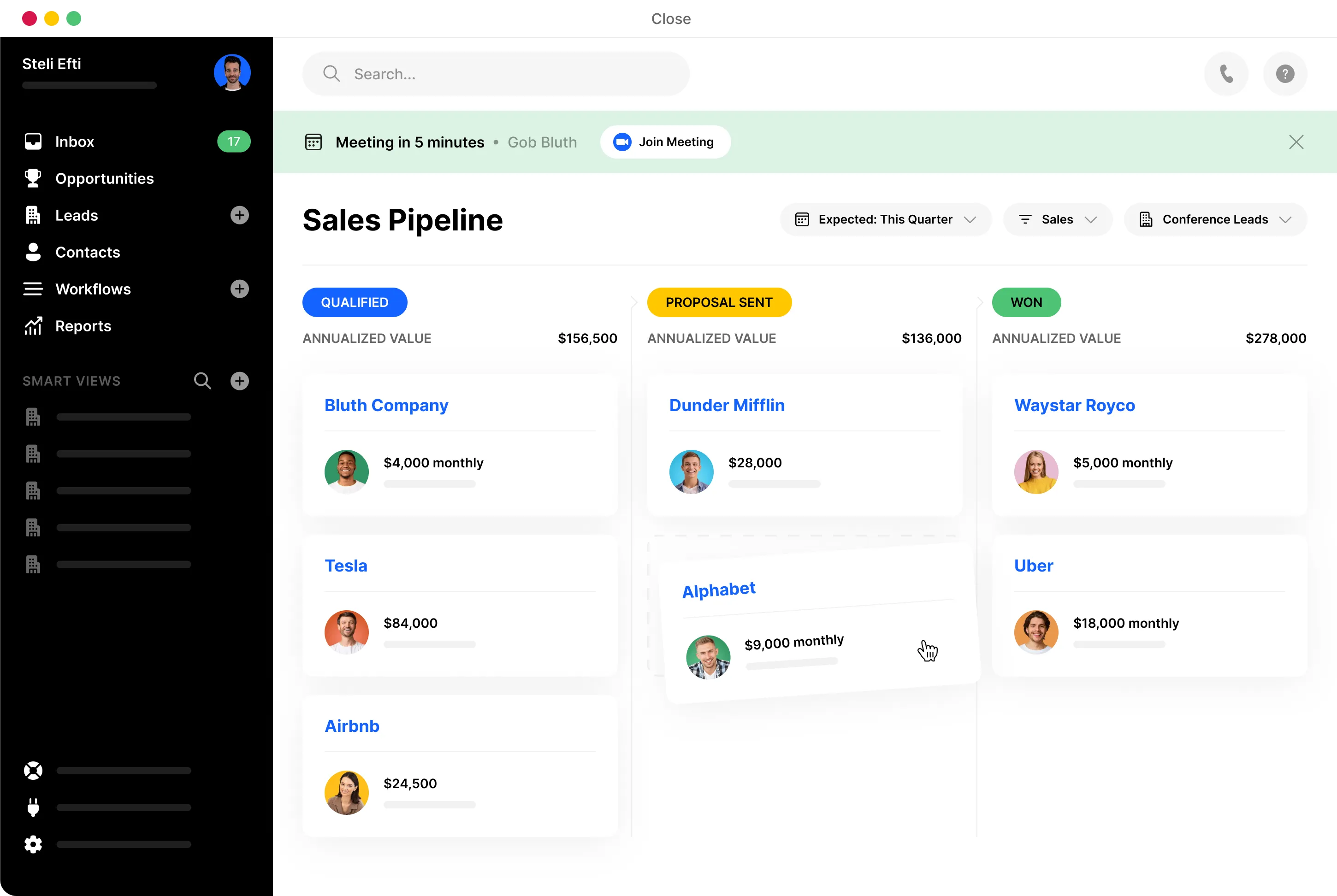

2. Close

Close is one of the most robust CRM solutions globally. It's the ultimate private equity CRM due to its exceptional time-saving capabilities, remarkable communication features, and strong focus on sales effectiveness.

Key Features:

- Unified Communication Hub: Close consolidates calling, texting, and emailing into a single dashboard, offering automation based on lead behavior for seamless interaction management.

- Deal Flow Segmentation: It efficiently categorizes leads, facilitating targeted messaging for enhanced lead engagement and conversion.

- Sales Operations: Close streamlines marketing and sales stack setup and management, including custom integration, syncing, and sales training, tailored to your business needs.

- Rapid Connection: Leveraging Close's Power Dialer, sales reps can swiftly connect with leads without busy tones and answering machines in as little as 3 seconds.

- Hassle-Free Migration: Close ensures a smooth transition by migrating data from your existing CRM at no cost, within one week, and follows up to ensure everything runs seamlessly.

Pros:

- Time-efficient communication tools streamline interaction management.

- Quick lead connection through the Power Dialer enhances sales effectiveness.

- Hassle-free data migration simplifies transitioning from existing CRMs.

- Extensive support and follow-up ensure smooth onboarding and ongoing support.

Cons:

- Pricing plans may be relatively higher for some businesses, especially startups.

- While the Power Dialer speeds up lead connection, it may require additional training for optimal utilization.

Pricing:

- Startup: $49 per month (1 user), billed annually.

- Professional: $299 per month (3 users), billed annually.

- Enterprise: $699 per month (5 users), billed annually.

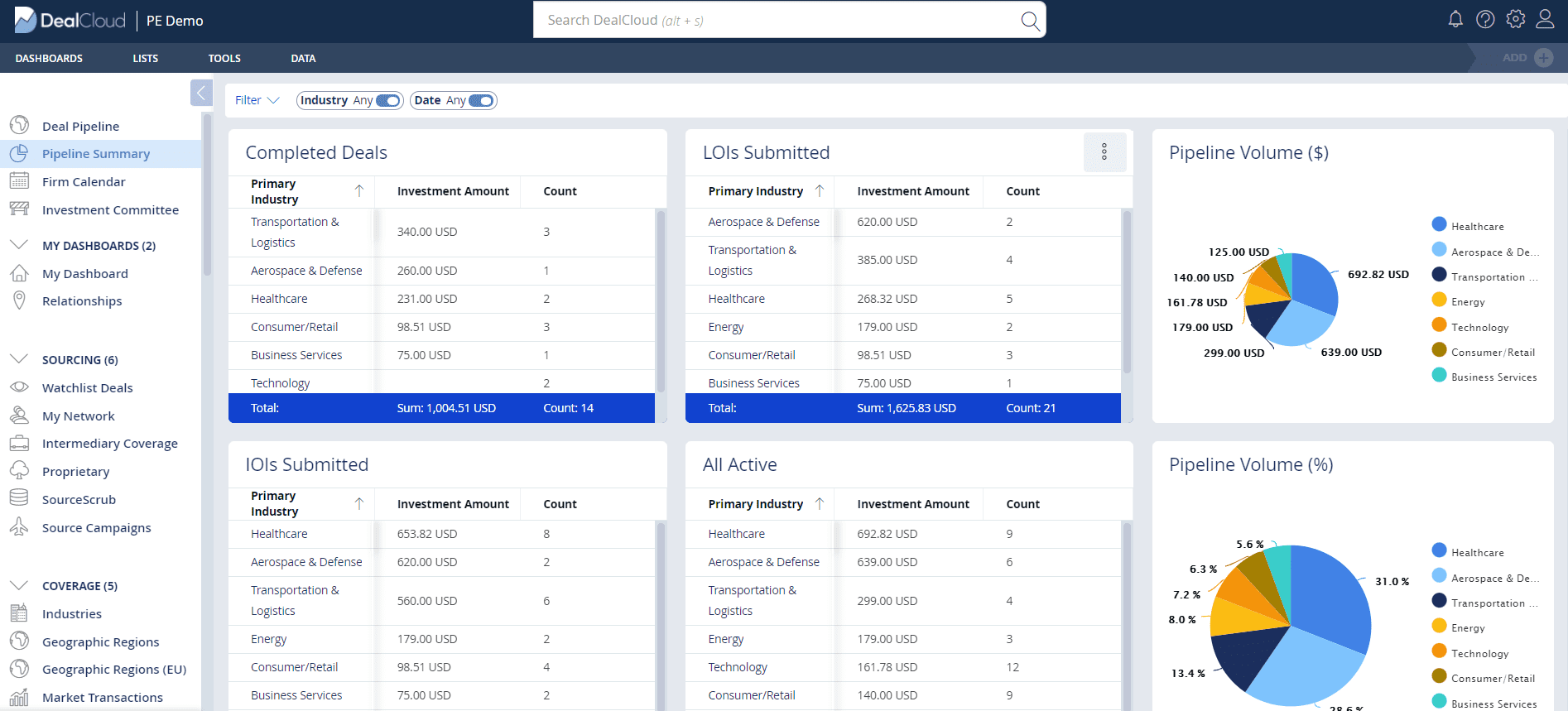

3. DealCloud

DealCloud stands is an advanced, all-in-one CRM for private equity tailored to the unique needs of investment firms. It's the best option for investment firms due to its efficient data integrations, private equity-specific analytics, and robust relationship management tools.

Key Features:

- Fundraising Management: Seamlessly manage fundraising processes, track investor commitments, and monitor progress in real-time to ensure efficient capital raising.

- Custom Reporting and Analytics: Generate personalized reports and analytics that allow you to track essential business metrics effortlessly from a centralized dashboard.

- Mobile App: Stay connected and keep deals moving while on the move with DealCloud’s intuitive mobile app, available for both iOS and Android devices.

- Conflicts Management: Identify and effectively manage potential conflicts of interest to uphold trust and credibility with investors and stakeholders.

- Dedicated Training Resources: Access DealCloud University's extensive courses to maximize your CRM usage, with free enrollment available for all users.

Pros:

- Tailored industry customization.

- Comprehensive deal pipeline management.

- Focus on relationship intelligence.

- Robust data security and compliance measures.

- Investment management capabilities, including portfolio management and performance tracking.

Cons:

- Limited offline functionality, requiring a stable internet connection for optimal usage.

- Complexity for non-technical users in making adjustments independently.

Pricing:

DealCloud offers a customizable pricing model to suit the specific needs and budget of your firm.

[Related article: 10 Best CRM Software for Banks: Make a Choice of Your CRM for Investment Banking]

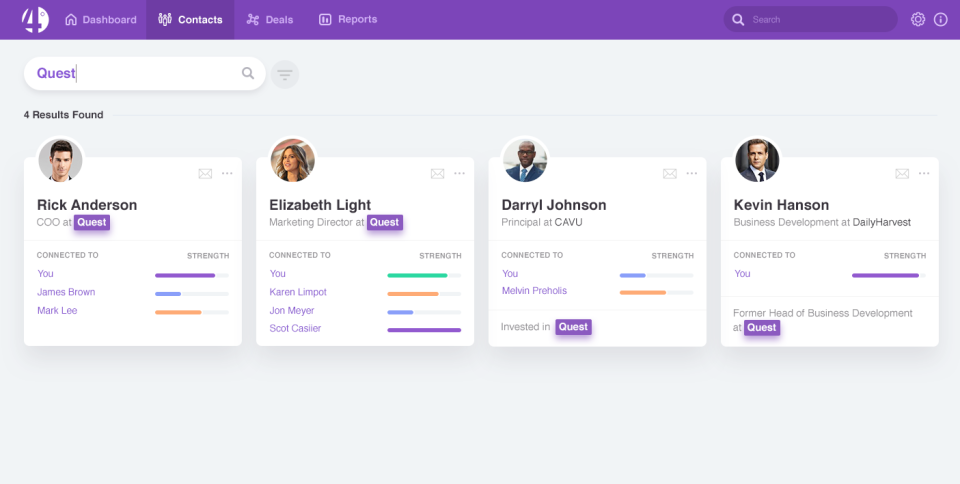

4. 4Degrees

4Degrees emerges as a modern private equity CRM solution equipped with robust features for building meaningful connections. It offers third-party data enrichment, powerful integrations, and outstanding Chrome extension.

Key Features:

- Personalized Warm Outreach: Uncover the strongest connections between your team members and potential contacts, facilitating relationship-building efforts.

- AI-Powered Relationship Management: Receive real-time updates when a contact changes employment, tweets, or appears in the news.

- Work and Travel Power-Up: Receive comprehensive email lists of relevant potential connections when visiting new cities or countries, enhancing networking opportunities.

- Third-Party Data Sourcing: Seamlessly integrate database platforms like PitchBook and Crunchbase to give your contacts up-to-date information.

- Customizable Reporting: Track investment stages with flexible deal tracking views, leveraging unique insights about your leads.

Pros:

- Developed by investment experts with deep industry knowledge.

- Strong emphasis on data security and compliance.

- Customizable workflows reflecting unique investment processes.

- Comprehensive lP and portfolio management capabilities.

- Automated relationship strength scoring.

- Email and calendar sync functionality for streamlined communication management.

Cons:

- Limited customization and integration opportunities.

- Implementation complexity may require hiring a consultant for assistance.

Pricing:

4Degrees offers a custom pricing model tailored to meet the specific needs and requirements of your firm.

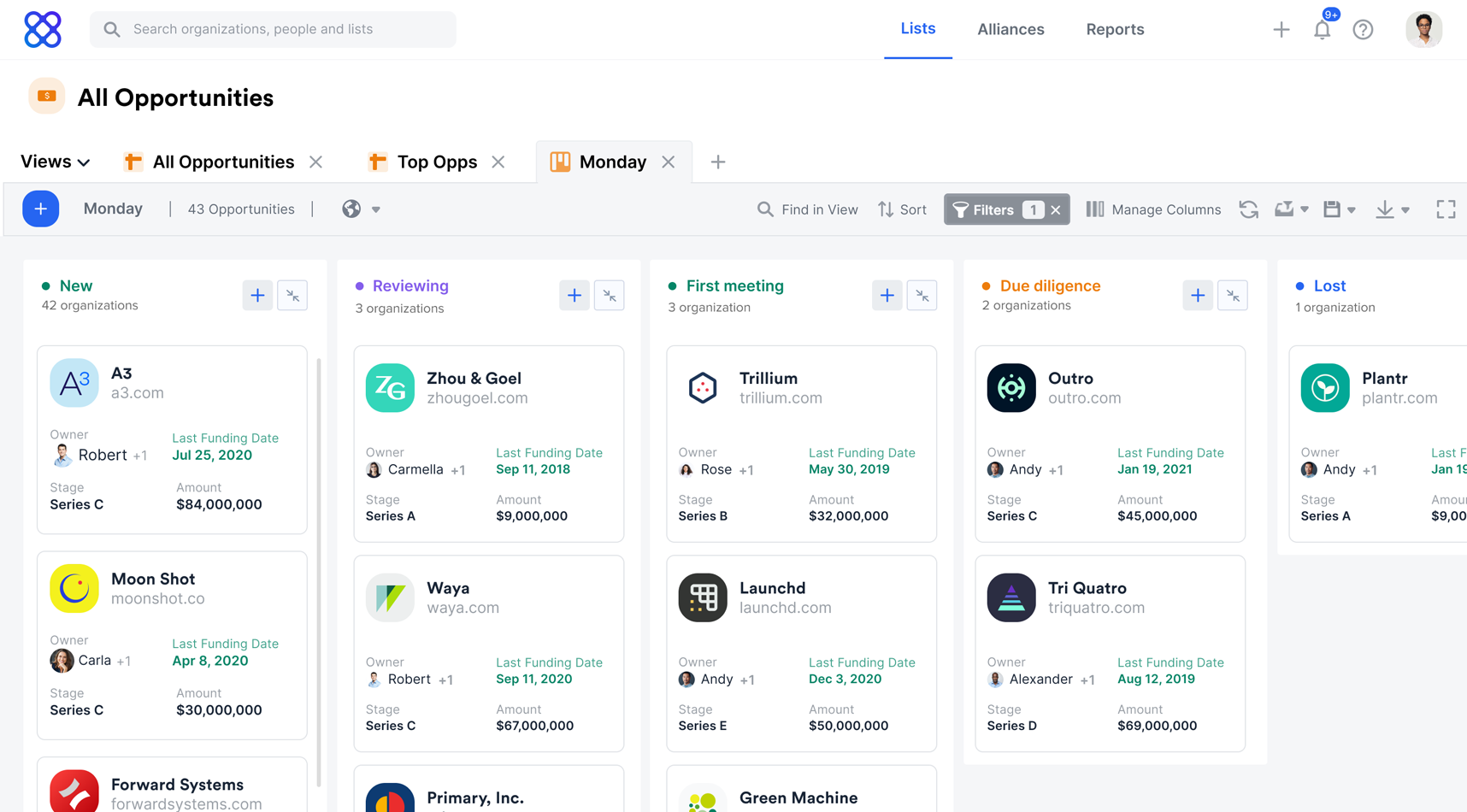

5. Affinity

Affinity is the best private equity CRM solution tailored for efficient portfolio and deal management. It provides features like relationship intelligence features, deal management capabilities, and automated record creation.

Key Features:

- Automated Data Entry: Seamlessly capture and input data from emails, calendar interactions, and various sources using Affinity's advanced relationship intelligence.

- Streamlined Network Visibility: Gain comprehensive visibility into your network relationships, enabling you to pinpoint potential deal opportunities and referral sources effortlessly.

- Smart Pipeline Management: Maintain a full pipeline effortlessly with Affinity's automatic deal sourcing feature, ensuring no opportunity slips through the cracks.

- Seamless Integration: Utilize Affinity alongside your existing CRM and marketing solutions such as Salesforce, HubSpot, and Mailchimp for enhanced efficiency.

- Accessibility Everywhere: Access Affinity seamlessly from various tools, thanks to its extensions for Chrome, Outlook, Zoom, and mobile devices.

Pros:

- The intuitive and easy-to-navigate interface ensures a seamless user experience.

- Comprehensive relationship mapping capabilities.

- Affinity seamlessly integrates with a diverse range of software applications, including accounting, marketing automation, and email marketing tools.

- Top-notch customer support via phone, email, and online chat services offered by Affinity CRM.

Cons:

- Affinity relies on external data sources for enrichment, which may pose limitations in certain scenarios.

- Limited analytics and reporting capabilities compared to some competitors.

- The complexity of certain features within Affinity CRM might be overwhelming for novice users.

Pricing:

Affinity offers a custom pricing model tailored to meet the specific needs and preferences of your private equity firm.

[Related article: Best Financial Reporting Software in 2024]

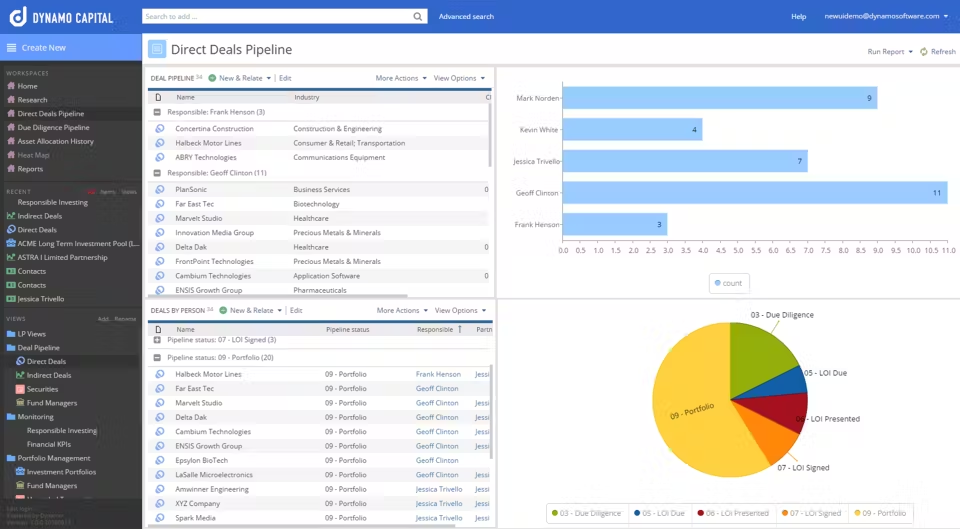

6. Dynamo

Dynamo software provides solutions for investment fundraising, including features beyond just private equity, yet allowing teams to monitor essential data. Its offerings include deal management, manager tracking and due diligence, investor relationship management, and workflow automation.

Key Features:

- Deal Management: Dynamo facilitates efficient management of deals, allowing private equity firms to track and monitor the progress of various investment opportunities.

- Manager Tracking and Due Diligence: The platform enables firms to conduct thorough due diligence on fund managers and track their performance, aiding in informed investment decisions.

- Investor Relationship Management (IRM): Dynamo offers robust tools for managing relationships with investors, including communication tracking, investor portal access, and reporting functionalities.

- Workflow Automation: With Dynamo, private equity teams can streamline their operational workflows through automation, saving time and improving efficiency in deal execution and investor communications.

- Mobile Access: While limited to iPhone and iPad devices, Dynamo offers mobile access, enabling team members to stay connected and productive while on the go.

- Integration with Common SaaS Tools: Dynamo integrates with popular SaaS tools such as DocuSign, Office, and Pitchbook, facilitating seamless data exchange and workflow integration.

Pros:

- A wide range of tools covering investor relations, deal tracking, and more, eliminating the need for multiple software solutions.

- The platform offers customization options, enabling firms to tailor it to their specific operational needs.

- Dynamo provides extensive support, ensuring users can swiftly address any issues.

Cons:

- Manual data entry, akin to many first-generation CRMs, along with reported challenges in interest transfers.

- Frequent updates may necessitate users to adapt and relearn certain functionalities periodically.

- Lack of mobile app available for Android.

Pricing:

Pricing details are not provided on the website.

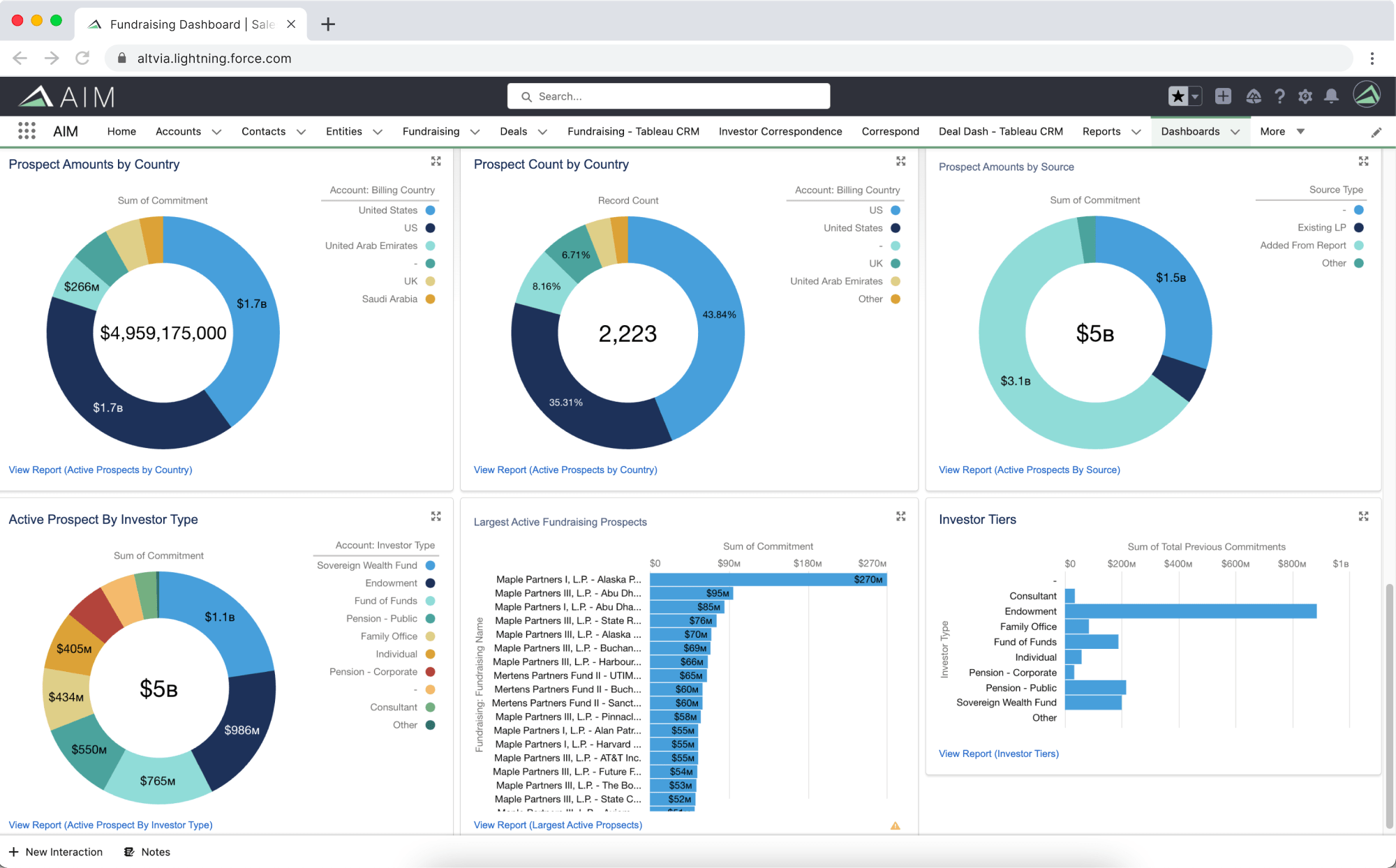

7. Altvia

Altvia is specifically created for private equity and built atop Salesforce for venture capital, and other alternative investment firms. It enables general partners (GPs), limited partners (LPs), and portfolio managers to collaborate effectively within a unified system. Altvia equips private equity firms with essential features like due diligence support, marketing automation, and portfolio metrics.

Key Features:

- Comprehensive Collaboration: The platform facilitates seamless collaboration among general partners (GPs), limited partners (LPs), and portfolio managers within a unified system, enabling efficient communication and information sharing.

- Due Diligence Support: Altvia provides robust support for due diligence processes, helping firms streamline the evaluation of investment opportunities and manage critical documentation effectively.

- Marketing Automation: Altvia offers advanced marketing automation capabilities, allowing firms to automate marketing campaigns, track interactions with investors, and manage communication efficiently.

- Portfolio Metrics: With Altvia, private equity firms gain access to comprehensive portfolio metrics, enabling them to track performance, monitor key indicators, and make informed decisions about their investments.

- Artificial Intelligence Insights: Altvia incorporates artificial intelligence (AI) to provide insights from various data sources, offering valuable information to users for decision-making purposes.

- Custom Reporting and Data Analytics: The platform offers robust tools for custom reporting and data analytics, empowering firms to derive actionable insights, visualize trends, and analyze performance metrics effectively.

- Integration Capabilities: Altvia integrates seamlessly with Salesforce, providing users with the flexibility to connect with other third-party tools and systems, enhancing overall operational efficiency and data management.

Pros:

- Altvia is customized specifically for the private equity and alternative investment sectors.

- Altvia's support team is knowledgeable about the unique challenges faced by private equity firms.

- Altvia provides powerful tools for firms to extract actionable insights and make informed, data-driven decisions.

Cons:

- New users, especially those unfamiliar with Salesforce, may encounter a learning curve when navigating Altvia.

- Integration capabilities with third-party tools are restricted or may require additional customization.

Pricing:

Altvia`s pricing is not available on the website. You should contact the vendor.

8. Clienteer

Clienteer is a cloud-based CRM platform hosted on Azure®, specifically designed for professionals in the financial services sector, such as private equity, wealth management, and family offices. It equips users with tools for managing relationships, tracking deals, and conducting data analytics, aiming to streamline workflows and foster collaboration in handling client connections and investment procedures.

Key Features:

- Relationship Management: Clienteer offers robust tools for managing client relationships, including client profiling and interaction tracking.

- Deal Tracking: The platform enables users to track deals comprehensively, providing visibility into deal pipelines and progress.

- Data Analytics: Clienteer includes powerful data analytics capabilities, allowing users to get insights from their financial data and investment processes.

- Campaign Management: Users can manage campaigns, roadshows, and events marketing efficiently, targeting prospects and investors with precision.

- Custom Reporting: Clienteer allows for the creation of custom reports, including watermarked and branded fund factsheets, to meet specific reporting requirements.

- Cloud Hosting: Hosted on Azure®, Clienteer ensures reliable and secure cloud-based access to the platform's features and data.

- Integration: Clienteer integrates seamlessly with other tools and systems commonly used in the financial services industry, enhancing workflow efficiency.

Pros:

- Offers various subscription levels and deployment options, ensuring scalability to meet diverse needs.

- Places a strong emphasis on relationship management, facilitating client profiling and tracking interactions effectively.

- Supports comprehensive tracking of all aspects of the capital raising process.

Cons:

- Users may encounter occasional software lags, affecting the user experience.

- The feature-rich nature of Clienteer may pose a learning curve for new users.

- Complex customization may require technical expertise, potentially adding complexity to the implementation process.

Pricing:

Clienteer`s pricing is not available on the website.

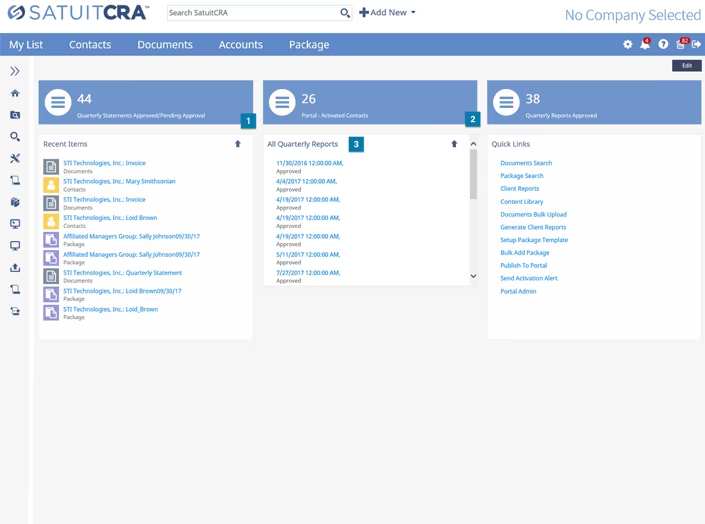

9. SatuitCRM

SatuitCRM stands out as a CRM solution tailored for investment professionals, with a focus on asset management, private equity, wealth management, and hedge fund industries. It equips users with tools for managing relationships, communicating with clients, and marketing funds, all geared towards streamlining workflows in investment management.

Key Features:

- Comprehensive Relationship Management: SatuitCRM provides robust tools for managing relationships with investors, clients, and stakeholders, enabling efficient communication and collaboration.

- Fund Marketing Capabilities: The platform includes features for marketing funds, managing campaigns, and planning roadshows and events, helping private equity firms attract and engage prospective investors.

- Report Packaging Software: SatuitCRM includes powerful report packaging software, empowering users to create and deliver customized reports efficiently.

- Mobile Access: With Satuit2GO©, users can access key CRM functionalities on the go, allowing them to stay productive and connected while working remotely or traveling.

- Customizable Dashboards: SatuitCRM offers customizable dashboards, enabling users to tailor their interface to display key metrics, reports, and insights relevant to their roles and objectives.

- Compliance Features: SatuitCRM includes features designed to support compliance requirements specific to the private equity industry, helping firms maintain regulatory adherence and data integrity.

Pros:

- SatuitCRM offers three specialized solutions: SatuitCRM©, SatuitSIP©, and Satuit2GO©, catering to specific needs within the investment sector.

- Users can choose between Cloud-based or on-premise deployment, providing flexibility to suit their preferences and infrastructure.

- SatuitCRM boasts a skilled support team and dedicated account managers who collaborate closely with clients post-installation, ensuring a smooth experience.

Cons:

- Users may encounter difficulties when integrating SatuitCRM with other tools.

- Compared to some other CRM platforms, SatuitCRM may not offer as much flexibility for customization.

- Some users may find that the system interface of SatuitCRM appears outdated compared to more modern alternatives like Salesforce.

- SatuitCRM may lack certain advanced features found in other CRM platforms, such as workflow automation and predictive analytics, which could limit functionality for some users.

Pricing:

Contact the vendor to get a pricing quote.

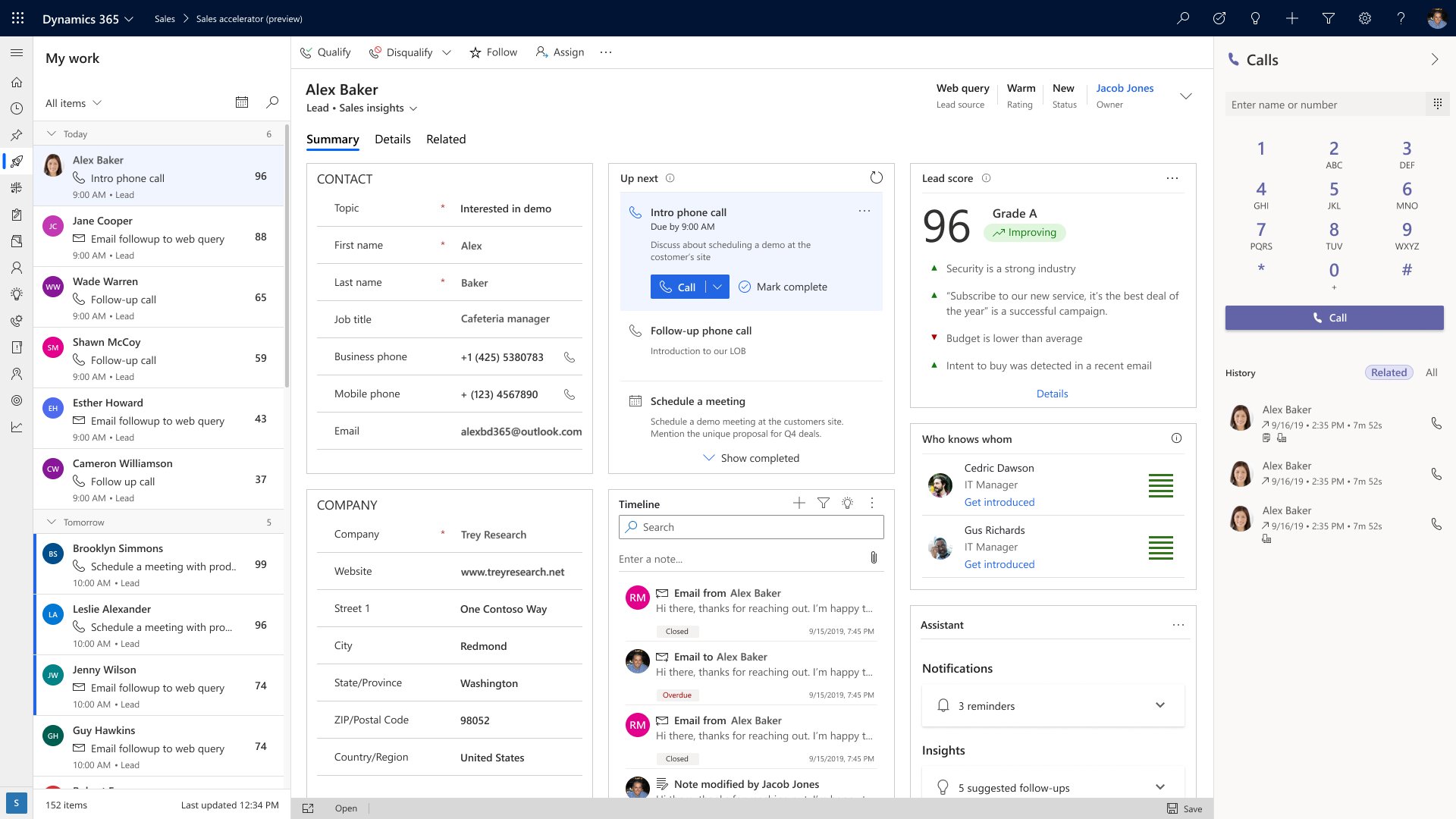

10. Xpedition Private CRM Accelerator

Xpedition Private CRM Accelerator is a cloud-based CRM solution tailored specifically for the private equity sector. Leveraging Microsoft Dynamics 365, Power Platform, and Azure Data Platform, it offers comprehensive functionality for managing fundraising, investor relations, workflow automation, and data analytics through Power BI.

Key Features:

- Fundraising and Investor Relations Management: Comprehensive tools for managing fundraising campaigns, tracking investor interactions, and nurturing investor relationships.

- Deal Management: Facilitates the tracking of deal pipelines, stages, and statuses, enabling efficient deal execution and monitoring.

- Fund Management: Provides robust functionality for tracking fund performance, monitoring capital commitments, and managing fund distributions.

- Portfolio Management: Enables portfolio monitoring, performance analysis, and risk assessment to optimize investment strategies and maximize returns.

- Power BI Integration: Integrates seamlessly with Power BI for advanced data analytics, allowing users to derive actionable insights from complex datasets.

- Briefing App: Offers a briefing application for secure communication, document signing, and negotiation within designated deal rooms, enhancing collaboration among stakeholders.

- Seamless Integration: Easily integrates with existing Microsoft and third-party applications, ensuring a cohesive ecosystem and maximizing productivity.

Pros:

- Seamlessly integrates with existing Microsoft and third-party applications, ensuring a cohesive ecosystem.

- Provides flexibility for customization to adapt to specific business requirements and workflows.

- Streamlines processes with automated workflows for deal origination, due diligence, and fund management, enhancing operational efficiency.

Cons:

- As a Dynamics-based product, Xpedition may have a sophisticated interface that could pose usability challenges for some users.

- Users may encounter glitches, necessitating the need for an in-house tech team to maintain the system effectively.

Pricing:

Pricing is not provided on the website.

Conclusion

In conclusion, CRM (Customer Relationship Management) software is an important component in the operations of private equity firms by facilitating efficient management of investor relations, deal pipelines, fund performance, and portfolio monitoring.

By leveraging CRM technology, private equity firms can enhance collaboration, streamline processes, and make data-driven decisions, ultimately driving greater efficiency, productivity, and success in their investment efforts.